We all want to start something somewhere, however small, not because our jobs don’t pay, but because we always need more money, and of course, the idea of being your own boss is just too tempting. To others, starting a business of their own is the only way to survive, whether due to limited job opportunities that render them jobless, poor working conditions, making them think of alternatives, or low wages that just don’t cut it. Whatever your reason, one thing is constant: we all need an income, and fortunately enough, there are many ventures a Ugandan can start up. True enough, I have a long list of such ventures, but today, we are starting a mobile money business.

What is Mobile Money?

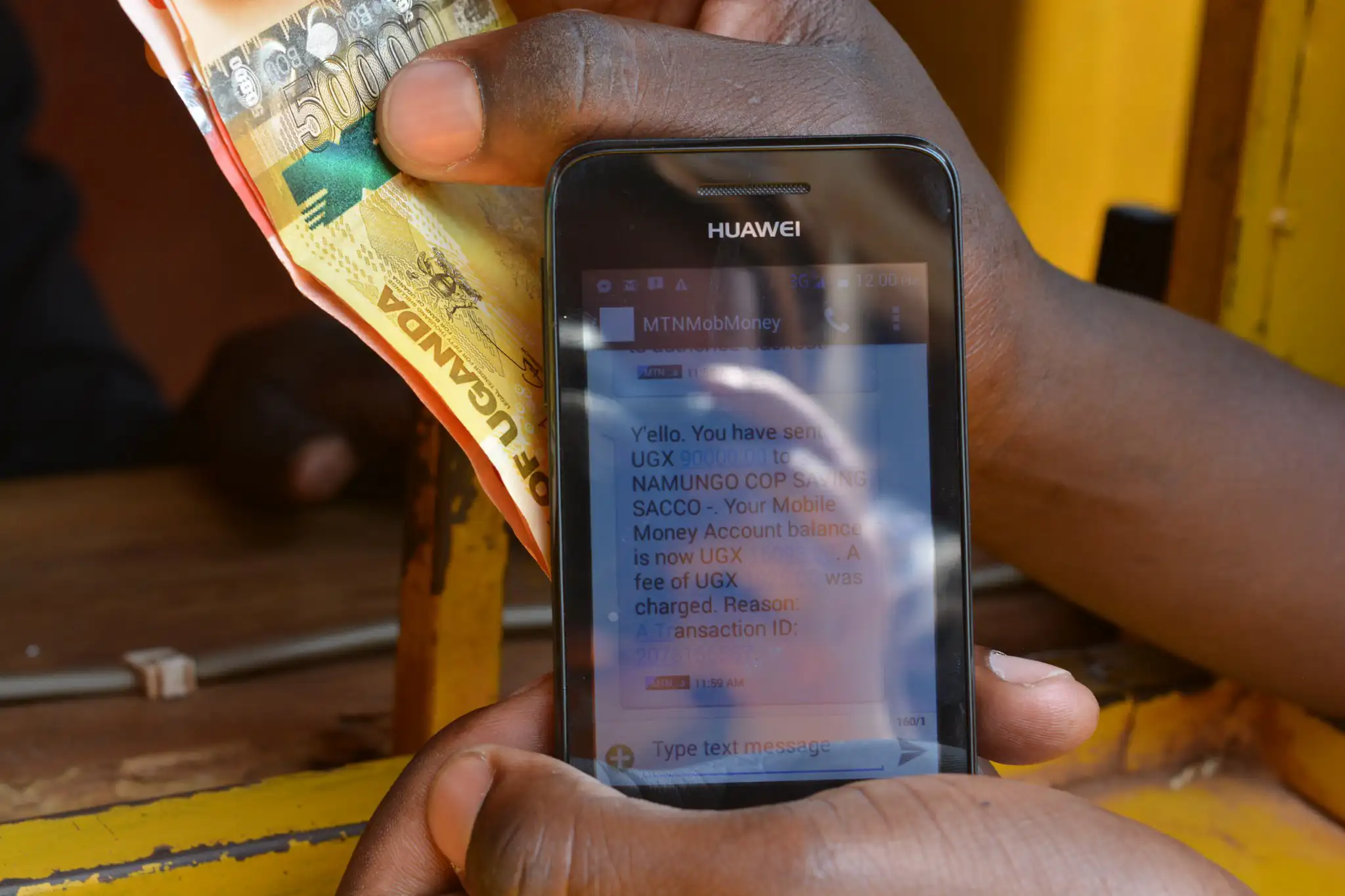

Mobile money is an electronic financial service that lets users send, receive, store, and sometimes borrow money on their phone using a mobile operator’s network. The service eliminates the need for traditional banking, making transactions easier, faster, and more accessible. Mobile Money’s major selling points are convenience and widespread availability.

Mobile money was introduced in Uganda around 2009, with MTN Uganda pioneering the service. Unlike our Kenyan neighbours, many Ugandans were initially sceptical, but it soon became the go-to financial service for both urban and rural populations. Airtel Uganda followed, and today, mobile money is Uganda’s leading digital payments platform, with thousands of agents nationwide. And if you are planning on joining those ranks, grab a pen and notebook; this is for you.

Starting a Mobile Money Business in Uganda

Before we start, dear reader, this is Uganda, we are hustlers. There are multiple ways to start a mobile money business, each with different startup requirements and qualifications depending on where and how you register.

How much do I need to start a Mobile Money Business?

(a). Buying Mobile Money Agent Lines

One agent may tell you the transaction SIM card is UGX 600,000, while some bloke on Jiji Uganda sells it for UGX 150,000. During our research, we even found a seller on Facebook Marketplace offering Mobile Money Agent Lines for UGX 60,000, with good reviews too. Simply put, the pricing for these lines is tricky.

(b). Mobile Money Float

One person might find it easy to start with a float of about UGX 300,000 in their area of trade, while another somewhere will find it impossible to operate with the same amount. In some cases, a single user could clear out the entire float, especially if someone withdraws UGX 800,000 early in the morning for tuition. As you can see, certain locations and agents need far more than UGX 1,000,000 to survive the day.

(c). Choosing a good spot for a Mobile Money Business

Location also plays a big role in determining how much you need to start a mobile money business in Uganda. For example, renting a veranda or shade in Kampala city centre or Ntinda won’t cost the same as in Kalerwe or Kyaliwajjala. Similarly, a rental shop in Naguru won’t have the same rental cost as one in Bwaise.

While we provide a budget for starting a mobile money business, the actual budget sums to several factors—luck in pricing, your bargaining power, location, and the route you take. Ultimately, you can start a mobile money business in Uganda with as little as UGX 600,000 to UGX 1,500,000 or more.

One route is highly formal, requiring a trading license, a certification from the Bank of Uganda, and business registration. Another route simply requires a stool, a table, a shade, your phone with SIM cards, and some working capital. While the latter may seem laughable, this is Uganda’s hustle culture and the Gig Economy

The Formal route of starting a Mobile Money business:

Like any other business, starting a mobile money business requires you to budget carefully, but before we go into that, here are the requirements that both MTN and Airtel list on their official pages.

(a). MTN Uganda requires you to visit the nearest service centre with the following

- National ID

- Original Business license.

- Certificate of incorporation / Business Permit

- Acceptance of terms and conditions.

- Capital to start with (at least UGX 200,000 as per their official website, although numerous sources state that the minimum is about 1-1.5 million shillings) to buy float and remain with cash to service cash-out customers. – MTN Uganda Official site

(b). Airtel Uganda requires different documents depending on how you register. If you’re registering as an individual, you won’t need documents like the certified copy of the Certificate of Registration of the business/firm name issued by URSB under the Business Names Registration Act or the certified copy of the Statement of Particulars of the Registered Business with a supporting statutory declaration. These are only required if you’re registering a mobile money agent under a business name.

Registering an Airtel Money agent using an Individual name

- Valid Trading license

- Bank statement or Active Airtel Money line

- Tin Certificate Image

- Operational business premises

- National ID

- Registered Airtel SIM card

- Operational capital (the float) depends on the area an agent operates in. (Some unofficial sources have it that the minimum float is around UGX 1 million, going up to UGX 3 million)

Registering an Airtel Money agent using a business name

- A certified copy of the Certificate of Registration of the business/firm name issued by USRB is required.

- A certified copy of the Statement of Particulars of the Registered Business and supporting statutory declaration is required for verification of the particulars.

- Valid Trading license

- Tax Identification Number (TIN) certificate of the Proprietor, if available

- Airtel Contact phone number of the Proprietor

- A recent coloured passport-size photograph of the Proprietor.

- Bank or Mobile Money Statement for at least 3 months. – Airtel Uganda official site

Starting up a Mobile Money business the Ugandan way (Requirements)

| Expenses | Est. Cost (UGX) |

| Mobile Money Float (starting capital for transactions) | At least 800,000 |

| Business Registration (Trading License) | 50,000 |

| Transaction SIM Cards (MTN & Airtel) | 400,000 |

| A Reliable Mobile Phone (Second-hand, dual-SIM) | 50,000 |

| Rent (Veranda or small kiosk space for 3 months) | 150,000 |

| Branded wooden signpost | 100,000 |

| Counter/Table for transactions | 70,000 |

| Plastic Chair | 20,000 |

| Record Book & Pen | 10,000 |

| Basic Security (Cash Box with a padlock) | 65,000 |

| Miscellaneous (Transport, Airtime, etc.) | 50,000 |

You might need a trading license depending on how you plan to launch the business, enough capital to purchase electronic float, and additional cash on hand for withdrawals; if you operate on a veranda, tax collectors may overlook you, unlike someone with a shop.

Preferably a dual-SIM phone to handle multiple networks. However, you may need more than one phone, each with its own SIM card, to serve multiple customers simultaneously.

A strategic location with high customer traffic determines your earnings. Agents earn through commissions—the higher the transaction volume, the bigger the commission. While trading centres may require more capital, they offer higher transaction amounts, leading to better earnings. In contrast, remote areas may have fewer transactions, security concerns, and lower demand, affecting profitability.

A booth, counter, branding materials, and a record book are essential. If you register directly with a telecom company and meet their requirements, they may provide branding tools such as posters with your business name alongside their logo, endorsing you as an official agent.

Mobile money agents handle large sums of cash, making them targets for theft. This is why many close early and avoid opening too soon. A strong cash box and CCTV (if possible) help secure shops. For those operating from verandas or shades, choosing a busy, well-populated area improves safety. Some agents open as early as 6 AM but only in locations with built-in security, such as trading streets with large buildings.

Types of Agent/Transactions SIM Cards in Mobile Money Business

These are special SIMs for conducting transactions from telecom companies. The cost of these lines varies depending on the tier of the SIM card/agent you choose, that is to say;

Agent: An agent is a person who is contracted to conduct mobile money transactions for users. Sometimes agents do register new customers. Agents are paid on commission for carrying out these services.

Master Agent: This is an individual or business that purchases e-money wholesale from a Mobile Network Operator (MTN or Airtel) and resells it to agents, who then sell it to users. Unlike a super-agent, master agents manage the cash and electronic-value liquidity requirements for a specific group of agents.

Super-agent: This is a business, sometimes a bank, which purchases electronic money from a Mobile Network Operator wholesale and then resells it to agents, who in turn sell it to users.

How to get a Mobile Money agent SIM card:

To operate as an official mobile money agent, you must register with a telecom provider for an agent transaction line. The most formal and secure method is to visit an MTN or Airtel service centre with the necessary documents to apply for an agent SIM card. However, there are other ways to acquire one:

(a). Through Master Agents

These are authorised middlemen who distribute agent SIM cards on behalf of telecom companies. They can guide you through the process, provide training, and manage a network of agents by providing/selling float to them, like an in-charge person managing the agents in a small region.

(b). Renting or Buying Existing Agent Lines

Some individuals and businesses rent out their mobile money agent lines, often with commission-sharing agreements. This saves you from the lengthy registration process, with rental fees typically ranging from UGX 50,000 to UGX 100,000.

How Mobile Money Agents Make Money

Agents earn through commissions paid by telecom companies for every transaction they process. Here’s how it works:

- Deposits (Cash-In): When a customer deposits money, the agent earns a small commission.

- Withdrawals (Cash-Out): Agents earn a commission when customers withdraw money.

- Other Services: Some agents also earn by selling airtime, handling bill payments, or registering new SIM cards. All company products earn commission when sold via an agent.

Commission Structures (2025 Rates)

Each telecom company has different commission rates. As of 2025:

Airtel Commission tables.

Note: These rates may change, so always confirm with your telecom provider.

How Much Can a Mobile Money Agent Earn?

Your income depends mostly on your location and transaction volume, but other factors like the kind of premises you rent (shop or veranda), employing someone or running the business yourself also affect how much you can earn. On average,

Urban Agents: UGX 500,000 – UGX 1,000,000 per month gross income without supplementary services.

Rural Agents: UGX 200,000 – UGX 500,000 per month.

With rent and an employee to run the business, one can manage to bag about 700,000 shillings per month. – condala.com

How to Increase Your Earnings as an Agent

While the sole activity the mobile money agents do is manage the transfer of money, there are many other supplementary activities an agent can do to increase income, that is to say;

Offer Additional Services: Sell airtime and data, handle utility bill payments, and register SIM cards.

Extend Business Hours: Stay open late to attract more customers, but also assess the security of staying out late.

Provide Excellent Customer Service: A friendly and reliable service will keep customers coming back, I, for one, have a favourite agent that I know by name and will use on all occasions except for when he is not around.

Expand to Multiple Locations: If possible, open more than one outlet to maximise earnings, although this will require some extra capital.

Challenges Faced by Mobile Money Agents in Uganda

Like any business, mobile money has its challenges, twists and turns.

Security Risks: Handling cash makes agents a target for theft and fraud. Over the years stories and cases have been around of agents robbed and killed over their money.

Float Management Issues: You need a balance between cash and electronic money, simply because the business is all about moving it. The moment your float depletes, you are at risk of failing to fulfil a customer’s transaction.

Regulatory Changes: The government and telecom companies may introduce new rules that affect commissions, for instance, the mobile money tax introduced back in 2018

Is Mobile Money Business Profitable in Uganda?

Yes! With a strategic location, good customer service, and smart business practices, you can build a profitable mobile money business. Whether you’re looking for a side hustle or a full-time venture, this is a great opportunity to earn a steady income, and many have successfully sustained themselves through it…and you could too.

Consider joining our WhatsApp Channel for more!

13 thoughts on “How to Start a Mobile Money Business in Uganda”

Thanks alot 👍

Can i swap my friends agent line to my names is it feasible

what are the requirements

You can, not feasible though

Good advice, do you have some ready lines and at how much i

It’s such a good business but how do i get a trading license without being scammed

KCCA offices.

Thank for this rich information.

how much does it cost to start a mobile money with airtel and MTN cards

which is the best place am out of Kampala am in Mukono mbalala, will I work to earn something good ?

Trading centres with shops, a market or busy roads

that’s good

how long does it takes for me to get mtn agent sim card if I have all the requirements

1-3 days depending on how and where you’re getting it.